This free programme develops students' awareness of, and understanding of some of the financial systems that are such an integral part of society.

Financial literacy can be taught through the curriculum areas of Mathematics, Social Sciences, English and through the Key Competencies of Managing Self, Using Language, Symbols and Texts, and Participating and Contributing. This means that it can be intertwined throughout the day, exposing students to the language and principles in a number of authentic context.

Students applied for classroom jobs to earn a weekly income by creating a CV. Students initially found it tricky to identify relevant skills and write a statement to improve their chances for employment. Selling yourself can be a difficult task for some while necessary when applying for a job.

I know how to save my money for bills and taxes. I can buy a car and houses and I pay for them by applying for a job.

Students could earn money in other ways. Being awarded a Tokarewa token in the playground or a sticker in the classroom earned them money. Students were awarded for improvements in basic facts recall scores and for their work in literacy. Effort brings reward.

They had to manage their money between their savings and everyday accounts in order to be able to meet weekly payments for power and internet and to make decisions to purchase houses and vehicles.

I have started to learn about banking. I can move my money to my savings account and I could buy vehicles and houses.

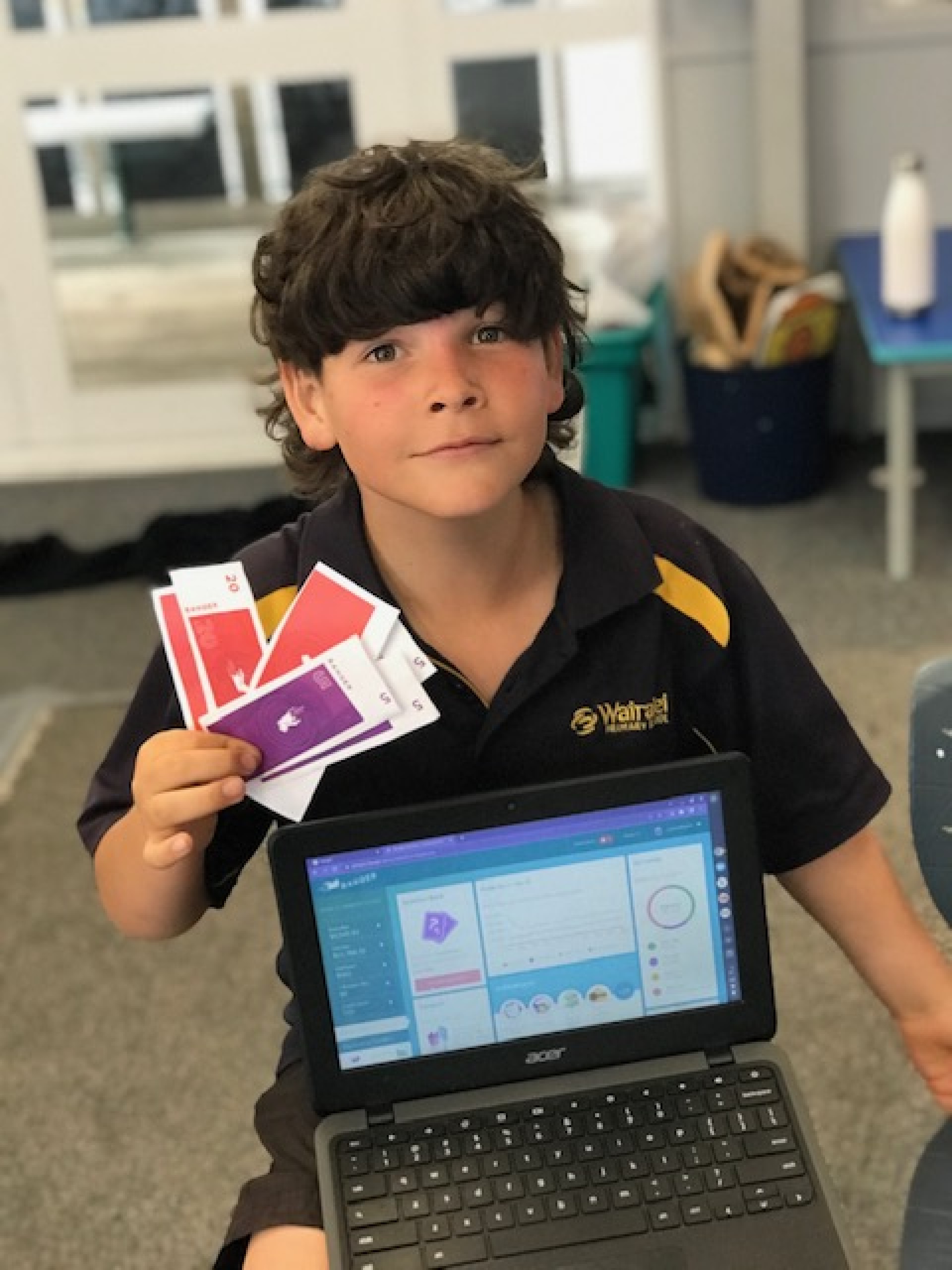

Although this is a digital programme, students earned money and were paid in ‘cash’ at times. They collected this cash and filled in deposit slips before taking it to the ‘banker’ to be deposited into their online bank account.

Tough lessons were learnt when insurance was not purchased to protect their assets. Students realised the value of paying a little bit each week to ensure their assets were safe when natural disasters and accidents occurred in this virtual world.

I learnt that floods could happen and so I need insurance to protect my house.

As a class we set financial goals and benchmarks where items could be purchased. This meant that students could choose to be careful with their spending - making smart decisions for long term financial gain. Items could be purchased along the way - a chocolate bar for $1000, stationery items for $2500, a lunch bought by the teacher for $5000 or even a mini lego set for $10000. Interestingly, students often opted for the quick purchase rather than saving for the larger, more expensive item.

I have learnt that you shouldn’t spend your money on everything you want but don’t need.

Using Banqer I have learnt how to apply for jobs, and how to work on saving my money for bigger things that I really want.

Collectively the class decided that if we could earn $100,000 in total that would buy a class movie and popcorn. They all watched throughout the term as the class's net worth grew closer and closer towards this target. In Week 10 the class celebrated as they hit this milestone.

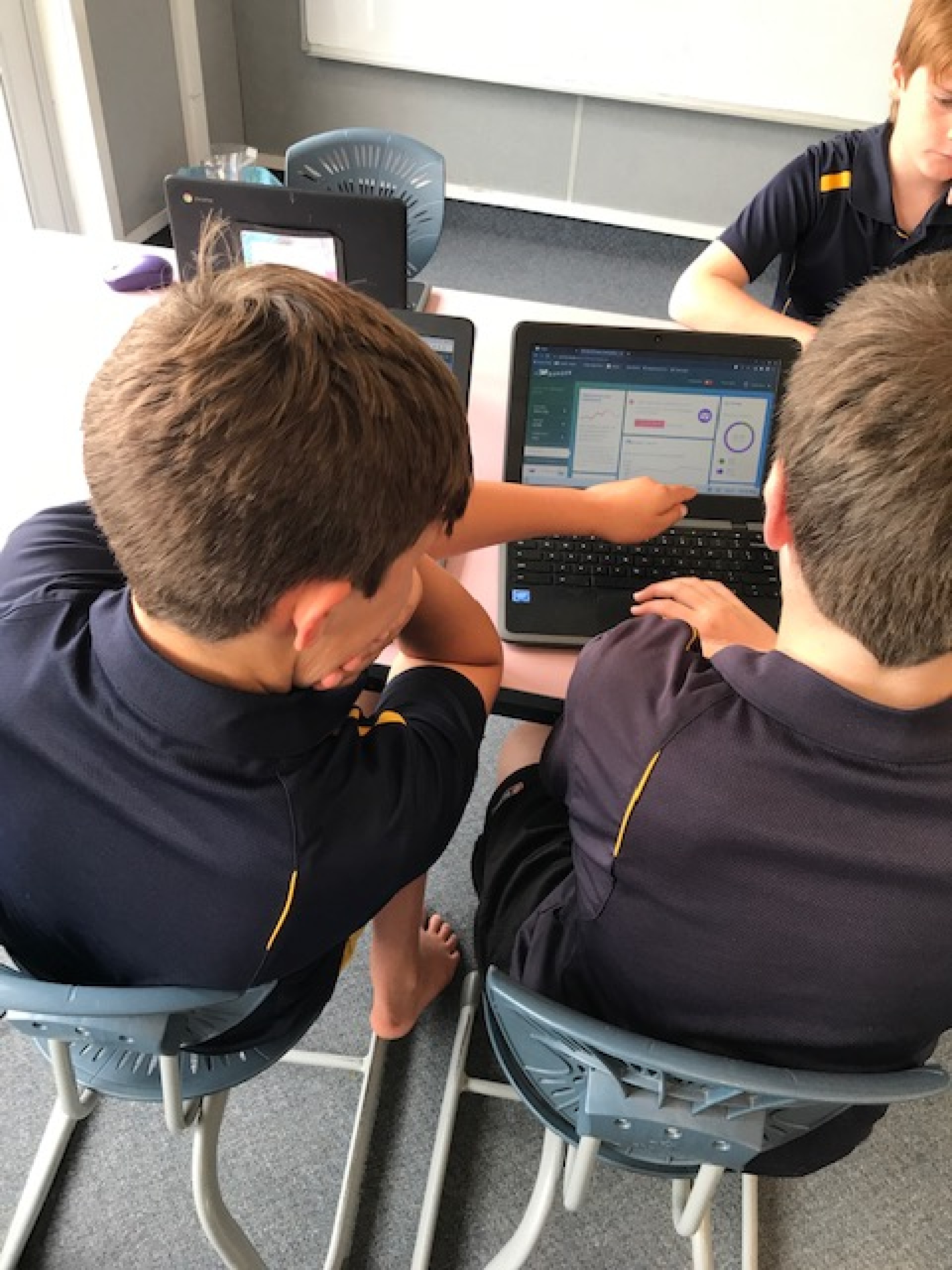

Using Banqer in class has meant that students are having important conversations about money and finances linked to mathematics and classroom routines.

Since the start, Room 11 have taken on a leadership role, teaching the students of Room 9 the in's and out's and do’s and don’ts of Banqer and managing your finances. Students have not been so quick to take on more than one mortgage and insurance has been an early purchase this time around - showing the growth in their understanding of finances.

The identified learning outcomes for the students are:

Developing financial capability supports ākonga to:

-

participate in economic life

-

gain the knowledge, skills, and competencies to make good money management decisions across a range of financial contexts

-

improve the financial well-being of individuals and society.

In becoming financially capable, students will develop:

-

knowledge and understanding of financial information and processes

-

personal financial management competencies

-

recognition and development of their personal values, which make it possible for them to achieve their personal goals

-

an awareness of others' values and priorities, which will enable them to participate meaningfully in the community.

https://nzcurriculum.tki.org.nz/Curriculum-resources/Financial-capability

Comments are disabled for this post.